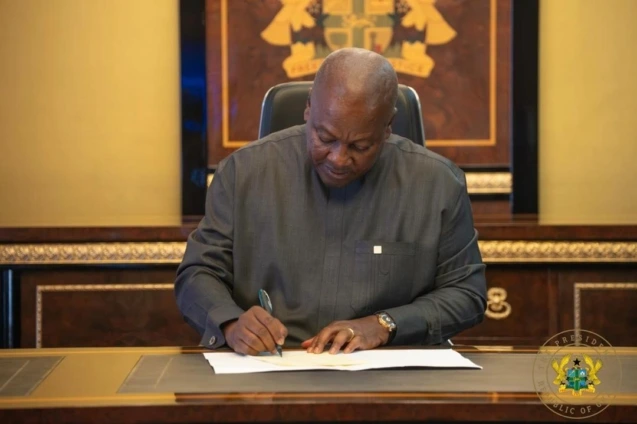

President John Dramani Mahama has assented to the COVID-19 Health Recovery Levy Repeal Act, 2025, officially abolishing the one percent levy that was imposed on goods, services and imports during the peak of the COVID-19 pandemic. The signing, which took place on Wednesday, December 10, paves the way for the levy’s complete removal starting January 2026.

Introduced in 2021, the levy was aimed at supporting Ghana’s pandemic recovery efforts, including restoring the health sector, financing COVID-19 expenditures and rebuilding the country’s fiscal buffers. Over time, however, many businesses and consumers criticised the tax for increasing operational and living costs, calling for its withdrawal as economic conditions improved.

Government officials say the repeal reflects Ghana’s strengthening economic and health indicators and forms part of broader plans to boost economic activity, reduce financial pressures and support household spending. The decision is expected to bring relief to businesses and consumers who have long advocated for a rollback of the COVID-19-era tax.